Wealth Concentration Leads to Wealth Extraction

Wealth and the Depletion of Equity

Whether we realise or not we all have a Balance sheet as at a specific point in time and an Income statement (Profit and Loss) that applies for a given time-period. This is as true as are the laws of the universe. Whether one refers to these facts in accounting terms (Balance sheet) or not, the fundamental truth is that everything in the world, also within any country, belongs (and is also owed) to some physical or legal entity. The net worth, or owner’s equity, is the difference between Assets and Liabilities of one’s balance sheet and represents the wealth that accrues to the entity it refers to. A balance sheet that has no liabilities simply means that the sum of all assets in the balance sheet are a correct and accurate measure of the wealth that ensues to that physical or legal entity (company or institution).

This is true even in a barter economy (one without money). It simply means that an economy is made up of agents who own and exchange wealth between them. Whether their wealth is their physical assets (land, property) or their labour services, people engage in the act of exchange with others and in the process, they create new wealth as the most competent specialise and focus on the production of goods and services they can be best at and more economically efficient on. Money has no intrinsic value (it is not by itself wealth) but simply facilitates the act of exchange.

Collateral lending has become the norm in a loosely regulated banking environment in the world today. This means that the granting of a loan is based primarily on the availability of collateral assets and guarantees of the borrower rather than on the economic viability and the repayment capability of the project or object to be financed. An economy where reckless collateral lending is allowed to deplete the equity of the balance sheets of its people (households and enterprises) amplifies inequality by transferring existing wealth from the many to the few rather than in creating new wealth for all. This inevitably leads to economic decline and recession through debt peonage as the economic agents of the country cannot participate in the productive wealth creation process.

Extreme Wealth Inequality

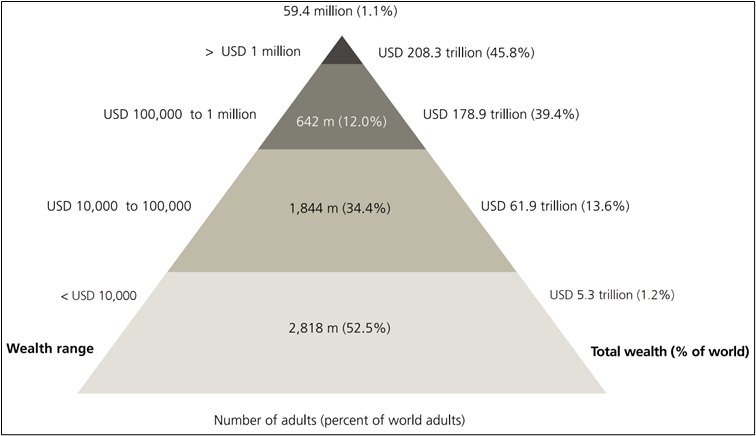

Wealth is not something that can be easily gauged, let alone to be measured with accuracy. As an indication however of the concentration of assets in the hands of the few, the pyramid in Figure 1 summarizes the distribution of wealth among adults worldwide (Davies, Lluberas and Shorrocks 2023). The wealth share of the global top 1% is estimated to be 44.5%. As noted in the report, “the number of global millionaires has been growing rapidly in recent years and exceeded 1% of adults and in terms of wealth ownership, High Net Worth Individuals (HNW) is increasingly dominant. The aggregate wealth of HNWs has grown five-fold from USD 41.4 trillion in 2000 to USD 208.3 trillion in 2022, and their share of global wealth has risen from 35% to 46% over the same period”.

Figure 1 - The Global Wealth Pyramid 2022

Risk Aversion and the Derailment of the Real Economy

The pursuit of a return without the risk amidst a largely deregulated financial markets environment systematically derails and compromises the real economy. As pointed out in (Savvides 2022b), “Risk aversion by the wealthy and the depletion of entrepreneurs’ equity through unproductive debt combine to create two destructive separations Risk from Return and Ownership from Entrepreneurship”. Extreme inequality and the risk averse attitudes of the wealthy distort and misdirect the real economy.

Risk and return are two sides of the same coin. An attempt to separate one from the other inevitably leads to wealth extraction rather than wealth creation. The pursuit of a return without the risk amidst a largely deregulated financial markets environment systematically derails and compromises the real economy. The depletion of equity through unproductive lending creates a separation of ownership from entrepreneurship causing the real economy to underperform.

Extreme wealth concentration such as the one that the world is experiencing inevitably becomes an obstacle which impedes an economy from reaching its full potential through productivity and free market exchange of the many in the real economy. It is therefore imperative that wealth should be widely available and spread out among the various economic agents of an economy so as to facilitate entrepreneurial specialisation and to enable a process of efficient exchanges to take place in a competitive free market environment and the economic efficacy that results from this and which in turn fosters economic development and enhanced welfare for the public at large.

An equally important reason against extreme inequality in an economy relates to the risk averse attitudes of the elite that have come to own the wealth. Not only they lack the skills and competence but also, and to some extent because of that, they opt towards investing in relatively low risk capital investments. Inevitably, this leads to rentier and non-productive activities that only exaggerate the inequality and tend to transfer existing wealth from the many to the very few (Paravisini, Rappoport, Ravina 2016).

This is inevitably facilitated by a dysfunctional banking and financial system that encourages the positioning of funds to unproductive and economically unproductive employment and uses, (Savvides 2022a). Lending is granted primarily and, in some cases, even totally on security considerations and collaterals that can be provided by the borrower rather than to be based on economic viability and after a proper assessment of repayment capability of the object of financing (often a capital investment or a project finance venture). Unavoidably this leads to broken balance sheets and the depletion of available equity for productive investments. Funding is hence directed towards the capture of existing assets rather than financing viable productive projects in the real economy.

In conclusion, wealth concentration and extreme inequality suffocate the real economy and lead to a transfer of existing wealth from the many to the few rather than creating new wealth that enhances general economic welfare. Moreover, a dysfunctional banking system and a practically totally unregulated financial market in the world ease and accelerate this process which further exaggerates wealth concentration and inequality and leads to debt peonage for the people at large.

References:

- James Davies, Rodrigo Lluberas and Anthony Shorrocks (2023), “Global Wealth Report 2022”, Global Wealth Databook 2023, Global Wealth Report – Credit Suisse (credit-suisse.com).

- Daniel Paravisini, Veronica Rappoport, Enrichetta Ravina (2016), “Risk Aversion and Wealth: Evidence from Person-to-Person Lending Portfolios”, Management Science 63(2):279-297. https://doi.org/10.1287/mnsc.2015.2317

- Savvides, Savvakis C. (2022b), “Risk Through the Looking Glass – The Pursuit of a Return Without the Risk”. World Economics Journal, Vol. 23, No. 4, December 2022.

- Savvides, Savvakis C., (2022a), “The disconnect of funding from wealth creation”. World Economics Journal, Vol. 23, No. 2, June 2022.

Savvakis C. Savvides is an economist, specialising in economic development and project financing. He is a former senior manager at the Cyprus Development Bank and has been a regular visiting lecturer at Harvard University and more recently at Queen’s University in Canada. Author page: http://ssrn.com/author=262460.

3287.99

3287.99 1275.09

1275.09