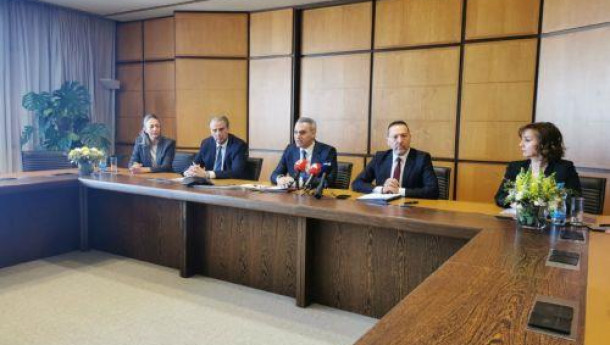

The cooperation between Greek and Cypriot banks is a positive development and a win-win situation, said Bank of Greece Governor Yannis Stournaras on Friday, commenting on the expansion of Greek banks in Cyprus and the acquisition of Cypriot banks by Greek banks, following the signing of a memorandum of understanding between the Central Bank of Cyprus and the Bank of Greece.

"We have a lot in common, the economies are very close," he added, noting that "trade (between the two economies) and capital transfers show that Greece and Cyprus are very close," in sectors such as tourism and shipping, among others.

He added that "today both Greek and Cypriot banks have cleared their portfolios of red loans to a very large extent, they are very strong capital-wise and so their cooperation is welcome."

In addition, CBC Governor Constantinos Herodotou said that from a supervisory perspective there is "absolutely common ground between the two supervisors in favour of increasingly resilient banks" and this is what the Single Supervisory Mechanism aims to achieve.

Asked whether uncertainty on the international scene will lead to a recession in the eurozone, Stournaras said that "we do not have a recession, we have a very small positive economic growth rate for 2023", stressing that "in 2024 we may have a somewhat higher (growth rate) and in 2025 it may be even higher".

Asked to refer to the risks that the European economy faces from climate change and whether the central banks of Cyprus and Greece have initiated studies on the matter, Stournaras said that the BoG is one of the first central banks that has dealt with climate change and has conducted a study on the impact in Greece, adding that this study is currently being updated.

For his part, Herodotou said that "we apply the resilience tests, in relation to climate change, to credit institutions directly supervised by the central bank, as the Single Supervisory Mechanism does for systemic institutions".

"We do the same for less systemic institutions," he said, adding that the CBC's portfolio "is adjusted towards a green investment policy."

Referring to plans the CBC is working on, Herodotou said a dialogue has been initiated with experts in the ESG (Environment - Social - Governance) sector "to see how we can bring about a new way of measuring and extracting data to help us in terms of how to determine the climate change impact on the economy".

He also said there are initial thoughts about creating a specific service within the bank on climate change.

3287.99

3287.99 1275.09

1275.09