The investments of the insurance funds of the life sector record positive yields in the past 12 months due to the ongoing upward trend of the international equity and bond markets.

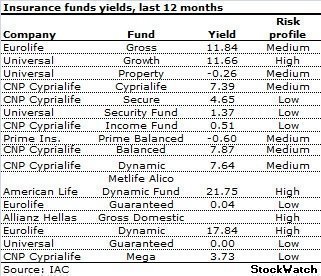

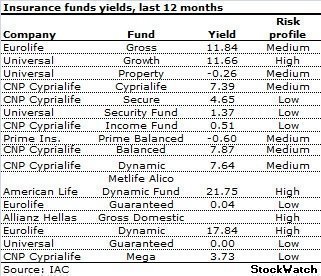

According to new data of the Insurance Association of Cyprus, of the 16 largest insurance investment funds, 13 have positive yields and only three have negative.

Despite the positive returns, many of the funds lose assets due to the households’ trend to redeem their insurance contracts as a result of liquidity shortage.

Among the 16 largest, the largest yield in the past twelve months reaching 21.75% is registered by Metlife Alico Dynamic of American Life of high risk followed by the Dynamic of Eurolife of high risk with 17.84%.

Among the 16 largest, the largest yield in the past twelve months reaching 21.75% is registered by Metlife Alico Dynamic of American Life of high risk followed by the Dynamic of Eurolife of high risk with 17.84%.

The yield of Eurolife Gross with assets of €323.9 million amounts to 11.84% and of Universal Life Growth to 11.66%.

According to Fund Manager of Eurolife Eugenios Antoniou, while the domestic economy is still in recession, the insurance investment funds, following investment policy mainly abroad, have made positive returns (in the last 12 months until 31/3/2015).

As noted, the positive returns of these funds are mainly due to the ongoing upward trend of the international equity and bond markets (in euro terms), which is largely attributable to the monetary policies followed by the central banks of the strongest states.

The Balanced of CNP has a yield of 7.87%, the dynamic of CNP Cyprialife of 7.64% and CNP Cyprialife of 7.39%

Negative yields have been registered by A/K Gross domestic Allianz Hellas, the Property of Universal Life and the Balanced Prime of Prime.

According to new data of the Insurance Association of Cyprus, of the 16 largest insurance investment funds, 13 have positive yields and only three have negative.

Despite the positive returns, many of the funds lose assets due to the households’ trend to redeem their insurance contracts as a result of liquidity shortage.

Among the 16 largest, the largest yield in the past twelve months reaching 21.75% is registered by Metlife Alico Dynamic of American Life of high risk followed by the Dynamic of Eurolife of high risk with 17.84%.

Among the 16 largest, the largest yield in the past twelve months reaching 21.75% is registered by Metlife Alico Dynamic of American Life of high risk followed by the Dynamic of Eurolife of high risk with 17.84%.The yield of Eurolife Gross with assets of €323.9 million amounts to 11.84% and of Universal Life Growth to 11.66%.

According to Fund Manager of Eurolife Eugenios Antoniou, while the domestic economy is still in recession, the insurance investment funds, following investment policy mainly abroad, have made positive returns (in the last 12 months until 31/3/2015).

As noted, the positive returns of these funds are mainly due to the ongoing upward trend of the international equity and bond markets (in euro terms), which is largely attributable to the monetary policies followed by the central banks of the strongest states.

The Balanced of CNP has a yield of 7.87%, the dynamic of CNP Cyprialife of 7.64% and CNP Cyprialife of 7.39%

Negative yields have been registered by A/K Gross domestic Allianz Hellas, the Property of Universal Life and the Balanced Prime of Prime.

3287.99

3287.99 1275.09

1275.09