The economic crisis slowed down the growth rate of the insurance sector. The insurance companies, however, tolerate the domestic economic recession but do not give significant market shares to the big players of the sector.

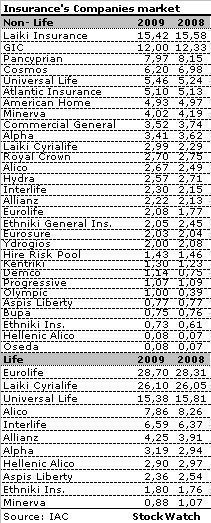

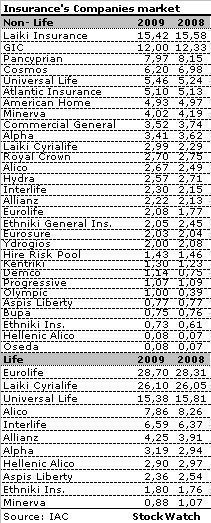

The new figures of the Insurance Companies’ Association show that the production rate of premiums in the general and life sectors fell in 2009 without big reclassifications in the market shares of the players.

Low rates in life sector

In the life sector, the total gross premiums recorded an annual increase of 3.48% against 6.36% in 2008.

According to the figures, the total production of premiums in the life sector stood at €353.2 million in January – December 2009 compared to €341.4 million in 2008.

According to the figures, the total production of premiums in the life sector stood at €353.2 million in January – December 2009 compared to €341.4 million in 2008.

The high degree of concentration in the life sector did not change significantly, with the five biggest companies holding a market share of 84.63%.

Eurolife, subsidiary of Bank of Cyprus, and Cyprialife, subsidiary of Marfin Popular Bank, rank first and second respectively. Eurolife with premiums of €101.4 million pushed its market share up to 28.70% from 28.31% in 2008.

Cyprialife with premiums of €92.2 million pushed its market share up to 26.10% from 26.05%. Universal Life ranks third with premiums of €54.3 million. UL reduced its market share to 15.38% from 15.81%. Alico and Interlife hold market shares of 7.86% and 6.59% respectively.

General sector

In the general sector (data available for 98.1% of the market), the production of premiums recorded an annual increase of 5.71% against 9.67% in 2008.

The vehicle insurance sector grew by 2.20%, while the fire insurance grew by 6.35%. On the other hand, the health sector achieved a growth rate of 14.39%.

Compared to the market shares of the entire general sector, Laiki Insurance ranks first with a market share of 15.42% and total premiums of €66.9 million. General Insurance of Cyprus holds 12% of the market shares and total premiums of €52.1 million, while Pangkypriaki ranks third with a market share of 7.97% and total premiums of €34.6 million.

The new figures of the Insurance Companies’ Association show that the production rate of premiums in the general and life sectors fell in 2009 without big reclassifications in the market shares of the players.

Low rates in life sector

In the life sector, the total gross premiums recorded an annual increase of 3.48% against 6.36% in 2008.

According to the figures, the total production of premiums in the life sector stood at €353.2 million in January – December 2009 compared to €341.4 million in 2008.

According to the figures, the total production of premiums in the life sector stood at €353.2 million in January – December 2009 compared to €341.4 million in 2008. The high degree of concentration in the life sector did not change significantly, with the five biggest companies holding a market share of 84.63%.

Eurolife, subsidiary of Bank of Cyprus, and Cyprialife, subsidiary of Marfin Popular Bank, rank first and second respectively. Eurolife with premiums of €101.4 million pushed its market share up to 28.70% from 28.31% in 2008.

Cyprialife with premiums of €92.2 million pushed its market share up to 26.10% from 26.05%. Universal Life ranks third with premiums of €54.3 million. UL reduced its market share to 15.38% from 15.81%. Alico and Interlife hold market shares of 7.86% and 6.59% respectively.

General sector

In the general sector (data available for 98.1% of the market), the production of premiums recorded an annual increase of 5.71% against 9.67% in 2008.

The vehicle insurance sector grew by 2.20%, while the fire insurance grew by 6.35%. On the other hand, the health sector achieved a growth rate of 14.39%.

Compared to the market shares of the entire general sector, Laiki Insurance ranks first with a market share of 15.42% and total premiums of €66.9 million. General Insurance of Cyprus holds 12% of the market shares and total premiums of €52.1 million, while Pangkypriaki ranks third with a market share of 7.97% and total premiums of €34.6 million.

3287.99

3287.99 1275.09

1275.09