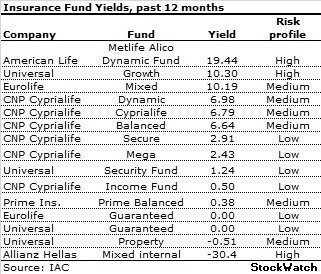

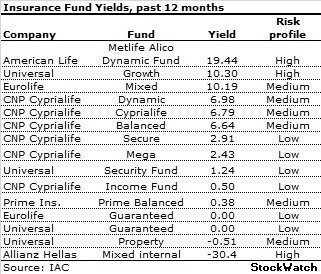

Life insurance funds continue to record positive returns during the last twelve months, according to new figures of the Insurance Association of Cyprus.

Based on the association’s latest data up to May 2015, 11 out of the 15 largest life investment funds had positive returns, two saw their returns reduced and two remained unchanged.

Despite the positive performance, many of the funds lose assets because of the trend to redeem insurance contracts due to the lack of liquidity in households.

Despite the positive performance, many of the funds lose assets because of the trend to redeem insurance contracts due to the lack of liquidity in households.

Among the 15 largest insurance funds, Metlife Alico Dynamic of American Life records the largest yield in the last twelve months standing at 19.44%.

Double-digit positive returns are also recorded by Universal's Growth and the mixed one of Eurolife.

The dynamic of CNP Cyprialife yields 6.98%, the Cyprialife yields 6,79% and the Balanced 6,64%.

Negative yields are recorded only by A / K Mixed of Allianz Hellas and Property of Universal Life.

The largest insurance fund is the mixed of Eurolife with assets of € 325,4 mn, followed by Growth of Universal Life at € 87,5 million.

Based on the association’s latest data up to May 2015, 11 out of the 15 largest life investment funds had positive returns, two saw their returns reduced and two remained unchanged.

Despite the positive performance, many of the funds lose assets because of the trend to redeem insurance contracts due to the lack of liquidity in households.

Despite the positive performance, many of the funds lose assets because of the trend to redeem insurance contracts due to the lack of liquidity in households.Among the 15 largest insurance funds, Metlife Alico Dynamic of American Life records the largest yield in the last twelve months standing at 19.44%.

Double-digit positive returns are also recorded by Universal's Growth and the mixed one of Eurolife.

The dynamic of CNP Cyprialife yields 6.98%, the Cyprialife yields 6,79% and the Balanced 6,64%.

Negative yields are recorded only by A / K Mixed of Allianz Hellas and Property of Universal Life.

The largest insurance fund is the mixed of Eurolife with assets of € 325,4 mn, followed by Growth of Universal Life at € 87,5 million.

3287.99

3287.99 1275.09

1275.09