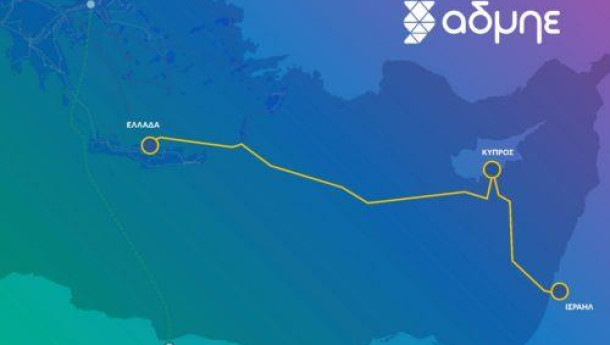

RAAEY, Greece’s Regulatory Authority for Waste, Energy and Water has issued a decision with regard with the calculation of the regulated income for the electricity interconnection between Greece and Cyprus, called Great Sea Interconnector, marking a significant step towards completing the regulatory framework governing the €1.9 billion project, the project promoter the Greek Independent Power Transmission Operator (IPTO) has said.

Ιn a briefing note, the IPTO also said that on July the Operator management will visit Cyprus to hand over the complete cost and benefit analysis to the Cypriot Energy Minister. The initial finding of the CBA were presented to the Minister in early June. Cyprus requested the full report in order to take a decision to enter the project equity with €100 million.

On the decision taken by the Greek regulator, IPTO says the RAAEY acknowledged the need to pay income to the project promoter at the beginning of the construction period, in line with the Cyprus Electricity Regulating Authority’s initial decision in the summer of 2023, when the project was under the previous promoter (EuroAsia Interconnector.)

According to IPTO, in its decision RAAEY defines the allocation of operation expenditure at a rate of 50% - 50% adopting the IPTO’s proposal to assume a larger share of the operational cost compared with the 37% defined in the capital expenditure (Capex.)

The methodology provides for a stronger provision to cover geopolitical risk of the project, noting that expenditure will be covered in full by the regulatory asset base, something which is expected by the respective decision by the Cypriot regulator, due to the project’s national significance for both countries.

IPTO described the decision taken by RAAEY as extremely important as it averted “a suspension of the production of the sub-sea cable by the construction company Nexans due regulatory uncertainty.”

Furthermore, IPTO said the next landmark is the issuance of two decisions by the regulatory authorities of Greece and Cyprus for the completion of the regulatory framework after which a “notice to proceed” will be given to Nexans whereas the entrance of private investors to the project will be expedited.

The IPTO also said it had received a term sheet by a commercial bank covering the financing of the project, adding that the European Commission in a meeting with the two regulators has highlighted the need to end any pending issues on the regulatory framework.

Moreover, IPTO said it is in consultation with the European Investment Bank with a view for EIB to reconsider financing the project.

So far, the Great Sea Interconnector has been granted financing by the EU Connecting Europe Facility amounting to €657 million.

3287.99

3287.99 1275.09

1275.09