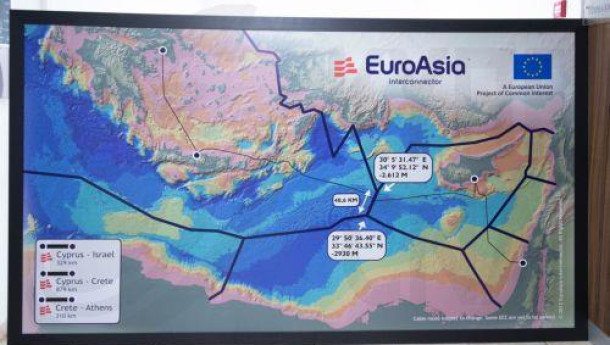

The government awaits an evaluation study regarding the economic viability and geopolitical significance of the EuroAsia Interconnector project before it takes any decisions regarding its involvement in the project, Government Spokesperson Konstantinos Letymbiotis said on Wednesday.

In statements after a meeting of the Council of Ministers at the Presidential Palace and responding to a journalist's question, Letymbiotis said that the decision of the Republic of Cyprus regarding its involvement in the project would be determined by the evaluation study. He noted that the assignment of this study was expected to be concluded in the coming week focusing on both the economic viability of the project and its geopolitical value.

In response to questions related to the economy, the Representative emphasised that the government's aim was to implement permanent, not temporary, measures to alleviate consumer burdens. He pointed out that "inflation is currently at low levels compared to the same period last year."

When asked whether the Government was considering support measures for consumers due to increases in fuel prices, electricity costs, and interest rates, the Spokesperson explained that the government has already taken additional steps to support households, such as applying a zero VAT rate to certain products and reducing it for others. He also mentioned that the Ministry of Finance was examining the possibility of expanding the list of products under this scheme, based on the state's economic capabilities.

"The government's goal is to promote measures that will be lasting, such as increasing the penetration of renewable energy sources in households, so as not to depend on a temporary subsidy policy," he said.

On the matter of taxing bank profits due to high interest rates, the Representative referred to statements made by the Minister of Finance and mentioned that a meeting between the Minister and the Association of Banks was pending. He noted that the Minister of Finance has already highlighted the difference between lending and deposit rates and has proceeded to make relevant remarks to banking institutions.

3287.99

3287.99 1275.09

1275.09