Premiums in life and general sector recorded a slight increase, according to latest figures of the Cyprus Insurance Companies Association.

In life sector, total gross premiums in the first nine months of 2011 recorded an annual increase of 3.74% to €389.9 million against €279.5 million in the corresponding period of 2010.

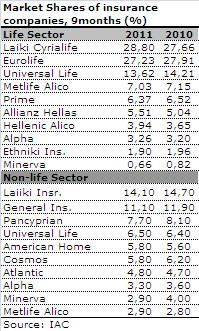

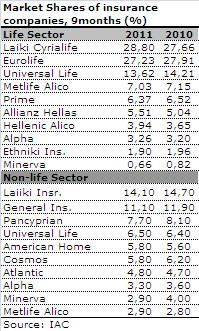

The high degree of concentration in the life sector did not change with the five largest companies holding a share of 83.1%.

Cyprialife, subsidiary of Marfin Popular Bank, ranks first with premiums of €83.5 million. It increased its market share to 28.8% from 27.66%.

Cyprialife, subsidiary of Marfin Popular Bank, ranks first with premiums of €83.5 million. It increased its market share to 28.8% from 27.66%.

Eurolife, subsidiary of Bank of Cyprus with premiums of €79 million, saw its market share declining to 27.23% from 27.91%

Universal Life ranks third with premiums of €39.5 million and a drop in its market share to 13.62% from 14.21%. Market shares of 7.03% and 6.37% are held by Metlife Alico and Prime.

In the general sector, premium production recorded an annual increase of 2.23% against an increase of 3.79% in the first nine months of 2010 as to the corresponding period of 2009.

The vehicle sector, the largest in general insurance, rose 0.13%, while the second largest, fire insurance, fell 0.17%.

On the other hand, the health sector soared 7.59%.

In relation to the market shares, Laiki Insurance ranks first with a market share of 14.1% and total premiums of €47.4 million.

General Insurance of Cyprus holds 11.1% of the market share and premiums of €37.3 million while Pangkypriaki ranks third with a share of 7.7% and total premiums of €25.9 million.

Smaller market shares are shared out by smaller insurance companies.

In life sector, total gross premiums in the first nine months of 2011 recorded an annual increase of 3.74% to €389.9 million against €279.5 million in the corresponding period of 2010.

The high degree of concentration in the life sector did not change with the five largest companies holding a share of 83.1%.

Cyprialife, subsidiary of Marfin Popular Bank, ranks first with premiums of €83.5 million. It increased its market share to 28.8% from 27.66%.

Cyprialife, subsidiary of Marfin Popular Bank, ranks first with premiums of €83.5 million. It increased its market share to 28.8% from 27.66%. Eurolife, subsidiary of Bank of Cyprus with premiums of €79 million, saw its market share declining to 27.23% from 27.91%

Universal Life ranks third with premiums of €39.5 million and a drop in its market share to 13.62% from 14.21%. Market shares of 7.03% and 6.37% are held by Metlife Alico and Prime.

In the general sector, premium production recorded an annual increase of 2.23% against an increase of 3.79% in the first nine months of 2010 as to the corresponding period of 2009.

The vehicle sector, the largest in general insurance, rose 0.13%, while the second largest, fire insurance, fell 0.17%.

On the other hand, the health sector soared 7.59%.

In relation to the market shares, Laiki Insurance ranks first with a market share of 14.1% and total premiums of €47.4 million.

General Insurance of Cyprus holds 11.1% of the market share and premiums of €37.3 million while Pangkypriaki ranks third with a share of 7.7% and total premiums of €25.9 million.

Smaller market shares are shared out by smaller insurance companies.

3287.99

3287.99 1275.09

1275.09