The deposit rates show signs of de-escalation lately, raising expectations for a gradual elimination of the distortions in the banking system to the benefit of the borrowers. The cheap money that the banks and the Coops received from the European Central Bank in December and the estimates for a marginal increase in loans started to change the climate in the banks and Coops, which stopped big offers to attract new depositors.

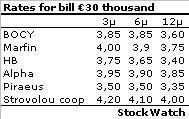

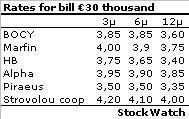

According to figures collected by StockWatch, the Coops still offer the highest rates of the market for deposits of €30 thousand but the gap with the banks becomes smaller and smaller and dropped to 20 points. In 2009, the gap had reached 50-75 base points, with the Cooperatives concentrating three fourth of the new depositors in the system.

The survey also shows that the interest rates offered by the banks are 15-20 points lower than those offered in December, when they were under pressure to maintain their liquidity indices in view of the end of the accounting year. For example, a big bank reduced the rates of the six-month bills by 30 base points in one day.

The de-escalation of the strong competition in deposit rates shows the width of the rates offered by the banks. In the 3-month bills, the difference reaches 70 base points, in the 6-month stands at 60 points and in the annual at 65 points. The visit to next door branch is cashed out today with additional rates of up to €195 in annual bills.

The condition in the deposit market raises expectations for a gradual elimination of the distortions in the banking system in the past two years. The strong competition between the banks and the Coops pushed deposit rates sharply up. As a result, the domestic rates of the business and housing loans are among the highest in the euro area.

The bankers believe that the increase in the cost of borrowing in Greece will have a similar impact on the cost of financing of the Greek banks, pushing deposit rates up.

At the current stage, however, the figures indicate that the Greek banks have lower deposit rates that the Cypriot.

According to figures collected by StockWatch, the Coops still offer the highest rates of the market for deposits of €30 thousand but the gap with the banks becomes smaller and smaller and dropped to 20 points. In 2009, the gap had reached 50-75 base points, with the Cooperatives concentrating three fourth of the new depositors in the system.

The survey also shows that the interest rates offered by the banks are 15-20 points lower than those offered in December, when they were under pressure to maintain their liquidity indices in view of the end of the accounting year. For example, a big bank reduced the rates of the six-month bills by 30 base points in one day.

The de-escalation of the strong competition in deposit rates shows the width of the rates offered by the banks. In the 3-month bills, the difference reaches 70 base points, in the 6-month stands at 60 points and in the annual at 65 points. The visit to next door branch is cashed out today with additional rates of up to €195 in annual bills.

The condition in the deposit market raises expectations for a gradual elimination of the distortions in the banking system in the past two years. The strong competition between the banks and the Coops pushed deposit rates sharply up. As a result, the domestic rates of the business and housing loans are among the highest in the euro area.

The bankers believe that the increase in the cost of borrowing in Greece will have a similar impact on the cost of financing of the Greek banks, pushing deposit rates up.

At the current stage, however, the figures indicate that the Greek banks have lower deposit rates that the Cypriot.

3287.99

3287.99 1275.09

1275.09