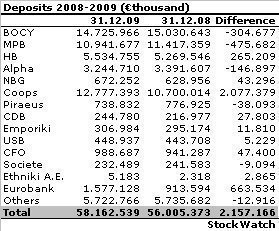

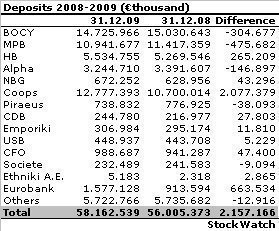

Almost all new deposits in the system ended up to the Coop coffers, since the bait of higher interest rates was good enough to convince thousands of depositors to turn their back to the banks. According to latest Central Bank data, the Cooperatives gained a big market share in 2009 to the burden of the commercial banks that lost millions in deposits as they prefer to improve their interest rate margins rather than their liquidity.

According to the figures elaborated by StockWatch, the Coops gained around €2.1 billion in additional deposits in 2009. The bait of higher interest rates allowed them to add 96% of the new deposits in their coffers.

Most of the money remained in the Coop coffers, since their credit balances recorded an increase of €1 billion.

On the other hand, the two biggest banks lost deposits of €0.8 billion in 2009. The drop in demand for loans reduced the liquidity pressures for the big banks, which preferred to improve their net interest rate margins, offering lower rates that the Coops.

The deposit portfolio of Bank of Cyprus fell to €14.7 billion in late 2009, showing net withdrawals of €0.3 billion, while that of Marfin declined to €10.9 billion with new withdrawals of €0.5 billion.

On the contrary, Hellenic Bank attracted new deposits of €0.3 billion, while Alpha Bank lost deposits of €0.1 billion. The deposit portfolio of Eurobank increased by €0.7 billion due to the transfer of deposit accounts from other subsidiaries of the Group.

On the contrary, Hellenic Bank attracted new deposits of €0.3 billion, while Alpha Bank lost deposits of €0.1 billion. The deposit portfolio of Eurobank increased by €0.7 billion due to the transfer of deposit accounts from other subsidiaries of the Group.

The inflow of new deposits to the Coops has raised concerns to the bank administrations, who believe that the deposit rates offered in the market are much higher than those justified by the European banking data. According to latest ECB data, the Cypriot deposit rates are the highest in the euro area. The banks support that the deposit rates push lending rates up, which are the highest in the euro area too.

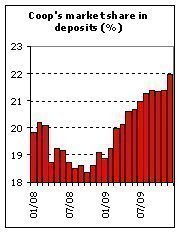

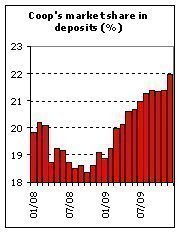

In 2009, the Coops increased their market share in deposits by 2.86 percentage points. The Coops support that the offer of higher rates allowed them to regain the market share that they lost in 2007, when the Cypriot and the Greek banks gave everything to gain new deposits to the burden of thye Coops.

The Coop market share stood at 21.97% in 2009 against 19.11% in 2008, 19.89% in 2007 and 21.55% in 2006.

According to the figures elaborated by StockWatch, the Coops gained around €2.1 billion in additional deposits in 2009. The bait of higher interest rates allowed them to add 96% of the new deposits in their coffers.

Most of the money remained in the Coop coffers, since their credit balances recorded an increase of €1 billion.

On the other hand, the two biggest banks lost deposits of €0.8 billion in 2009. The drop in demand for loans reduced the liquidity pressures for the big banks, which preferred to improve their net interest rate margins, offering lower rates that the Coops.

The deposit portfolio of Bank of Cyprus fell to €14.7 billion in late 2009, showing net withdrawals of €0.3 billion, while that of Marfin declined to €10.9 billion with new withdrawals of €0.5 billion.

On the contrary, Hellenic Bank attracted new deposits of €0.3 billion, while Alpha Bank lost deposits of €0.1 billion. The deposit portfolio of Eurobank increased by €0.7 billion due to the transfer of deposit accounts from other subsidiaries of the Group.

On the contrary, Hellenic Bank attracted new deposits of €0.3 billion, while Alpha Bank lost deposits of €0.1 billion. The deposit portfolio of Eurobank increased by €0.7 billion due to the transfer of deposit accounts from other subsidiaries of the Group. The inflow of new deposits to the Coops has raised concerns to the bank administrations, who believe that the deposit rates offered in the market are much higher than those justified by the European banking data. According to latest ECB data, the Cypriot deposit rates are the highest in the euro area. The banks support that the deposit rates push lending rates up, which are the highest in the euro area too.

In 2009, the Coops increased their market share in deposits by 2.86 percentage points. The Coops support that the offer of higher rates allowed them to regain the market share that they lost in 2007, when the Cypriot and the Greek banks gave everything to gain new deposits to the burden of thye Coops.

The Coop market share stood at 21.97% in 2009 against 19.11% in 2008, 19.89% in 2007 and 21.55% in 2006.

3287.99

3287.99 1275.09

1275.09