The Bank of Cyprus got the final approval for its shares to be traded in the Cyprus and Athens stock exchanges after the 21 tortuous months that followed its depositors’ bail-in.

According to the Chairwoman of the Cyprus Securities and Exchange Commission, Dimitra Kalogirou, all procedures have been completed and all clarifications have been provided in order to achieve a smooth return of the stock in the CSE and the Athex.

The stock will return to the two exchanges on Tuesday 16 December.

The stock will return to the two exchanges on Tuesday 16 December.

Trading of BOCY stocks was halted in March 2013, after the dramatic Eurogroup decisions.

Since then, the shareholder structure has changed completely, with the then shareholders now holding about 0.2% of the share capital.

Depositors who became shareholders due to the bail in now hold 43,4% of the share capital at a cost of € 1,00 per share while a 9,6% stake is held by ex Cyprus Popular Bank whose part of its operations were acquired by BOCY.

New shareholders who invested in the bank through this year's new issue hold about a 46,7% stake at a cost of € 0,24 per share.

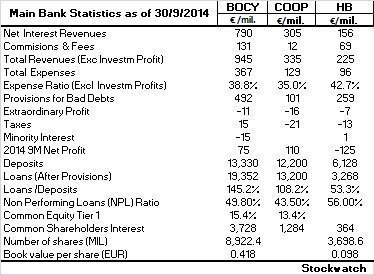

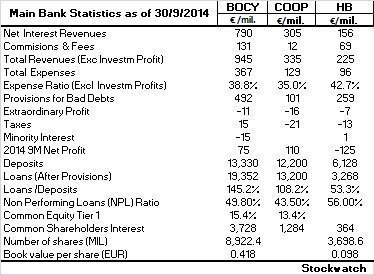

Through the new issue the bank raised €1 bil thus managing to improve its common equity tier 1 ratio to 15,4% which is comfortably above the 8% minimum requirement and according to its CEO John Hourican is one of the highest in Europee.

Currently the third and final stage of the new issue which is offered at €0,24 as well, is taking place in order to raise an additional €100 mil. The new shares are expected to be listed by February 2015.

The current book value of the share stands at €0,418 and will be adjusted to €0,41 after the conclusion of the final stage of capital raising.

The resumption of trading comes at a very difficult juncture due to the political instability in Greece which led to a dramatic deterioration of conditions in Athex. The Athex general index lost about 20% of its value during the last three sessions although today it was largely unchanged.

According to the Chairwoman of the Cyprus Securities and Exchange Commission, Dimitra Kalogirou, all procedures have been completed and all clarifications have been provided in order to achieve a smooth return of the stock in the CSE and the Athex.

The stock will return to the two exchanges on Tuesday 16 December.

The stock will return to the two exchanges on Tuesday 16 December.Trading of BOCY stocks was halted in March 2013, after the dramatic Eurogroup decisions.

Since then, the shareholder structure has changed completely, with the then shareholders now holding about 0.2% of the share capital.

Depositors who became shareholders due to the bail in now hold 43,4% of the share capital at a cost of € 1,00 per share while a 9,6% stake is held by ex Cyprus Popular Bank whose part of its operations were acquired by BOCY.

New shareholders who invested in the bank through this year's new issue hold about a 46,7% stake at a cost of € 0,24 per share.

Through the new issue the bank raised €1 bil thus managing to improve its common equity tier 1 ratio to 15,4% which is comfortably above the 8% minimum requirement and according to its CEO John Hourican is one of the highest in Europee.

Currently the third and final stage of the new issue which is offered at €0,24 as well, is taking place in order to raise an additional €100 mil. The new shares are expected to be listed by February 2015.

The current book value of the share stands at €0,418 and will be adjusted to €0,41 after the conclusion of the final stage of capital raising.

The resumption of trading comes at a very difficult juncture due to the political instability in Greece which led to a dramatic deterioration of conditions in Athex. The Athex general index lost about 20% of its value during the last three sessions although today it was largely unchanged.

3287.99

3287.99 1275.09

1275.09