Insurance firms have recently begun to focus on pension plans as related legislation and tax treatment have been finalised just a few months ago.

Pension plans are becoming increasingly important as a tool of subsidising one's income streams at the later stages of life, especially given the tighter rules governing regular social pension.

As the crisis took a heavy toll on salaries and pensions, securing a reasonable income after retirement appears to be an elusive goal as also evident by a recent study which shows that only 5% of the population will be able to retire at the age of 65 with sufficient financial resources to enable him to maintain his standard of leaving.

Pension plans are offered by the life-insurance companies as specialised products but their philosophy is similar to the more general category of investment plans.

Pension plans are offered by the life-insurance companies as specialised products but their philosophy is similar to the more general category of investment plans.

Retirement plans are available on either a collective basis by organisations for their employees or on an individual basis.

In the former case a contribution by the employer is also made besides the employee's contribution and thus benefits at retirement are enhanced, but there are limitations on the part accumulated from the employer in case the employee departs the company before retirement.

This acts as an incentive from the employer's side to its employees not to leave the company, while in case someone resigns, either the entire or part of the amount paid on his behalf by the employer, remains in the fund for the benefit of active members.

Such plans offer to the employer tax deductibility.

A major advantage of retirement plans as for all kinds of approved investment plans, is the tax deductibility of premiums which enable customers to enjoy lower tax obligations throughout the duration of the plan.

A premium is paid on a regular basis (monthly, quarterly, half-yearly, annually) which is then invested through various investment funds as per the combination desired by the customer.

The various investment funds cover a large spectrum of investments aiming at capital preservation on one-end and capital appreciation on the other, with the customer selecting what percentage of his premium will be invested in each.

The higher the potential return, the higher the associated risk and so for retirement plans a more conservative approach is desirable.

The portion of the premium that is invested becomes progressively higher with the rest covering the company's administration costs.

Retirement plans typically carry lower costs than life insurance plans depending on the life insurance plan with which they are usually offered something for which the final selection lies with the customer.

Typically a low value insured amount in case of death is selected and only in the case of accident.

The accumulated amount ( the sum of net premiums invested plus any returns ) are then paid to the beneficiary upon expiration of the plan.

The payment can be either in the form of a lump sum or in regular payments or a combination of the two something which is at the discretion of the customer.

The regular payments stop upon the customer's death but some plans offer the option of regular payments for a guaranteed period usually of ten years so if the customer dies before the expiration of this period, his legal beneficiaries will continue receiving this amount.

There is a wide array of features that can be incorporated to a retirement plan like variation of the premium at predetermined dates, variation of the insured sum, withdrawal or surrender of a number of investment units accumulated, single premium deposit at specific times for enhancement of the final amount and premium waiver in case of permanent disability.

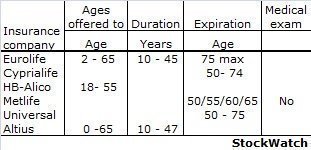

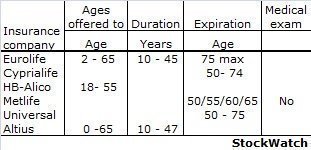

The plans are offered to specific age ranges the maximum of which is 65, and have a specific duration range usually between 10 and 47 years, while they expire between 50 and 75.

In some cases, medical examinations may not be required.

The shown table is not exhaustive as other companies may offer such plans.

Pension plans are becoming increasingly important as a tool of subsidising one's income streams at the later stages of life, especially given the tighter rules governing regular social pension.

As the crisis took a heavy toll on salaries and pensions, securing a reasonable income after retirement appears to be an elusive goal as also evident by a recent study which shows that only 5% of the population will be able to retire at the age of 65 with sufficient financial resources to enable him to maintain his standard of leaving.

Pension plans are offered by the life-insurance companies as specialised products but their philosophy is similar to the more general category of investment plans.

Pension plans are offered by the life-insurance companies as specialised products but their philosophy is similar to the more general category of investment plans.Retirement plans are available on either a collective basis by organisations for their employees or on an individual basis.

In the former case a contribution by the employer is also made besides the employee's contribution and thus benefits at retirement are enhanced, but there are limitations on the part accumulated from the employer in case the employee departs the company before retirement.

This acts as an incentive from the employer's side to its employees not to leave the company, while in case someone resigns, either the entire or part of the amount paid on his behalf by the employer, remains in the fund for the benefit of active members.

Such plans offer to the employer tax deductibility.

A major advantage of retirement plans as for all kinds of approved investment plans, is the tax deductibility of premiums which enable customers to enjoy lower tax obligations throughout the duration of the plan.

A premium is paid on a regular basis (monthly, quarterly, half-yearly, annually) which is then invested through various investment funds as per the combination desired by the customer.

The various investment funds cover a large spectrum of investments aiming at capital preservation on one-end and capital appreciation on the other, with the customer selecting what percentage of his premium will be invested in each.

The higher the potential return, the higher the associated risk and so for retirement plans a more conservative approach is desirable.

The portion of the premium that is invested becomes progressively higher with the rest covering the company's administration costs.

Retirement plans typically carry lower costs than life insurance plans depending on the life insurance plan with which they are usually offered something for which the final selection lies with the customer.

Typically a low value insured amount in case of death is selected and only in the case of accident.

The accumulated amount ( the sum of net premiums invested plus any returns ) are then paid to the beneficiary upon expiration of the plan.

The payment can be either in the form of a lump sum or in regular payments or a combination of the two something which is at the discretion of the customer.

The regular payments stop upon the customer's death but some plans offer the option of regular payments for a guaranteed period usually of ten years so if the customer dies before the expiration of this period, his legal beneficiaries will continue receiving this amount.

There is a wide array of features that can be incorporated to a retirement plan like variation of the premium at predetermined dates, variation of the insured sum, withdrawal or surrender of a number of investment units accumulated, single premium deposit at specific times for enhancement of the final amount and premium waiver in case of permanent disability.

The plans are offered to specific age ranges the maximum of which is 65, and have a specific duration range usually between 10 and 47 years, while they expire between 50 and 75.

In some cases, medical examinations may not be required.

The shown table is not exhaustive as other companies may offer such plans.

3287.99

3287.99 1275.09

1275.09