Why did Bitcoin drop? Crypto Analysts point to 5 potential reasons

Bitcoin's price fell approximately 8% in a span of 10 minutes, leaving crypto investors scrambling to make sense of the drop.

Elon Musk’s SpaceX reportedly selling its Bitcoin $26,575 holdings, the bankruptcy of a Chinese property giant Evergrande Group, and fears of interest rate hikes have been among the theories raised as to Bitcoin’s freak price dip.

On 18th of August 2023 around 12:35am, the price of Bitcoin suddenly plummeted over 8% in a span of 10 minutes, taking with it the wider cryptocurrency market, leaving many in the crypto community scratching their heads.

SpaceX offloads Bitcoin, interest rate fears

eToro market analyst Josh Gilbert pinned the drop on a report that SpaceX may have offloaded some or all of its $373 million in Bitcoin holdings, which came from an article dated 17th August 2023 from The Wall Street Journal.

“Whenever you have a big name in the industry selling Bitcoin, especially someone as influential as Elon Musk, it will put the price under pressure.”

Gilbert said another theory could be the rapid shift in sentiment, due to the broader markets’ expectations of future interest rate hikes from the U.S. Federal Reserve.

“If we also consider some of the weaknesses we’ve seen across global markets — particularly risk assets — over the last few weeks with the expectation that rates will likely stay higher for longer, it was a recipe for a pullback,” Gilbert explained.

“Bitcoin has struggled for a leg higher in the last month, trading in a tight range of between $29k and $30k with little ‘good news’ to push the asset higher, which has only exuberated this sell-off,” he added.

Government bond yields

Tina Teng, a market analyst from CMC Markets, shared a different opinion, looking to the recent rise in government bond yields as the root cause behind the sell-off.

Teng explained that increasing bond yields typically shows a reduction in liquidity for the broader market.

“This could be the primary reason that cryptocurrencies sank,” she said.

Additionally, Teng said that while the Evergrande Group crisis could have an indirect cause on the price of Bitcoin she did not believe that it was among the root causes of the decline. “This has more of an impact on sentiment toward the Chinese economy and investors,” she explained.

Chinese Yuan still a risk to Bitcoin

However, while Teng disregarded the Evergrande crisis as a major reason for Bitcoin’s price swing, Matrixport Head of Research Markus Thielen claimed the risk of a Chinese Yuan devaluation may have played a significant role in the sell-off.

“The biggest macro risk is a potential devaluation of the Chinese Yuan, which is trading at the weakest level since 2007.

“In August 2015, when China devalued the Yuan for the last time, Bitcoin prices declined by -23% during the two weeks following the devaluation. Before a more meaningful rally started, Bitcoin finished the year +59% from the level of the devaluation,” explained Thielen.

Whale’s selling big

While there were many other news events that could bear responsibility, pseudonymous derivatives trader TheFlowHorse told the press that the sudden move down could have resulted from a single large actor making a big sell, which then resulted in further pressure on derivatives.

“It was not just a natural cascade. Someone big bailed for a purpose and set it in motion. Spot volume barely compared to perps.”

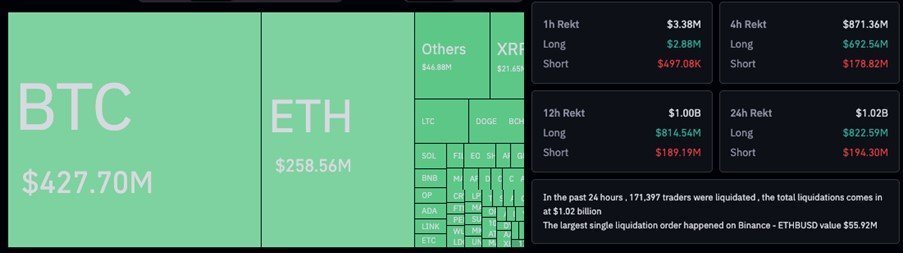

According to data from the crypto analytics platform Coinglass, more than $427 million in Bitcoin long positions were liquidated in the four hours to time of publication. Over the course of the last 24 hours, there had been more than $822 million in liquidations for traders with open long positions — a bet that the price of crypto assets would move upwards.

More than $427 million worth of Bitcoin long positions have been liquidated in the last 24 hours. Source: Coinglass

Describing much of the explanations for the decline as “pure speculation,” Horse suggested that since the reports of the SEC hinting its approval of an Ethereum Futures ETF came moments after the dump — a large fund may have offloaded their Bitcoin position to “trigger a cascade to buy ETH.”

Panayiotis A. Koussis

Senior Lawyer

|Blockchain | DeFi | DLT | AI | CASPs|

Linkedin: https://bit.ly/PKoussis

Instagram: https://bit.ly/pkoussis

PCV LLC: https://bit.ly/pelaghiaslaw

3287.99

3287.99 1275.09

1275.09