Introduction to Cryptocurrencies

Cryptocurrencies are a type of digital or virtual money that uses special technology to make them secure and decentralized. This means that, unlike traditional currencies like US dollars or Euros that are controlled by central banks, cryptocurrencies operate on networks of computers around the world and don't rely on any central authority. The most famous example is Bitcoin, but there are hundreds of different cryptocurrencies, each with their own features and uses.

At the heart of most cryptocurrencies is a technology called blockchain. A blockchain is essentially a digital ledger—a record-keeping system that stores transactions in a series of blocks. Each block contains a group of transactions, and once a block is full, it’s linked or "chained" to the previous block, forming a long chain of transaction records. What makes the blockchain special is that it's decentralized, meaning that no single person or company controls it. Instead, it's maintained by a network of computers (called nodes) that work together to verify and validate the transactions.

Because each transaction is checked by multiple computers and recorded across many different places, it's very difficult to alter or hack the blockchain. This transparency and security make cryptocurrencies attractive for many people who are concerned about privacy or don't trust traditional banks.

New transactions are verified and added to the blockchain using two main methods: Proof of Work (PoW) and Proof of Stake (PoS).

In PoW, transactions are verified by solving complex mathematical puzzles. PoW is very secure because it takes a lot of computational power and energy to solve the puzzles and validate transactions, making it difficult for hackers to take control of the network. The downside is that PoW uses a huge amount of electricity. Mining Bitcoin, for example, consumes as much energy as some small countries, which has raised concerns about its environmental impact.

In PoS, transactions are validated by people who already own a certain amount of the cryptocurrency. Instead of solving puzzles, these validators are chosen to verify transactions based on how much of the currency they hold and are willing to “stake” as collateral. One criticism of PoS is that it tends to favor people who already own a large amount of the cryptocurrency, which can create a system where the rich get richer.

Major Cryptocurrencies and Their Uses

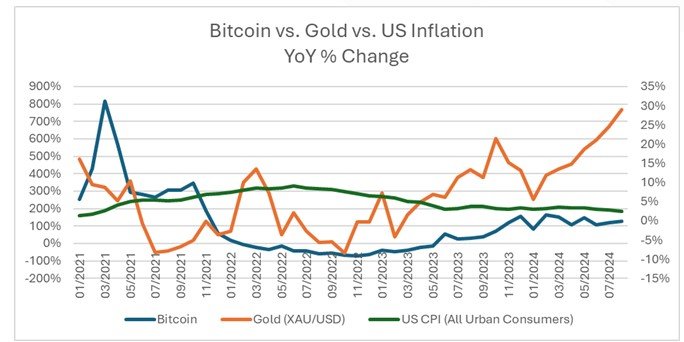

- Bitcoin (BTC): Bitcoin is the first and most well-known cryptocurrency. It was created in 2009 by an unknown person or group using the name Satoshi Nakamoto. People buy and hold Bitcoin as a way to protect their money from inflation, and it can also be used for making payments. Bitcoin is often referred to as "digital gold" because it's seen as a store of value, similar to gold. However, as the graph below shows, Bitcoin was not an effective hedge against inflation for the period Jan-2021 to Aug-2024[1].

- Ethereum (ETH): Ethereum is another popular cryptocurrency that was launched in 2015 by a programmer named Vitalik Buterin. Unlike Bitcoin, which is primarily used as money, Ethereum's main feature is its smart contracts. Ethereum allows developers to build decentralized applications (called dApps) that run on the Ethereum network. Smart contracts are like automated agreements that execute themselves when certain conditions are met. This has opened the door to decentralized finance (DeFi), where people can borrow, lend, or trade assets without needing a bank.

- Ripple (XRP): Ripple is a cryptocurrency that focuses on enabling fast, low-cost international money transfers. XRP is used by financial institutions as a bridge currency, meaning it helps convert one type of currency into another quickly, which can make cross-border transactions cheaper and faster than traditional banking systems.

- Tether (USDT): Tether is a type of cryptocurrency called a "stablecoin," meaning its value is tied to a stable asset like the US dollar. Tether is mostly used by traders who want to avoid the price swings (or volatility) of other cryptocurrencies. It allows them to move in and out of trades quickly without converting their funds into traditional currencies like dollars or euros.

Primary Risks of Cryptocurrencies

While cryptocurrencies offer many possibilities, they also come with risks that users need to be aware of:

- Volatility: Cryptocurrencies can be highly volatile, meaning their prices can swing up and down dramatically in short periods of time. While this can lead to big gains, it can also result in significant losses. For example, Bitcoin’s price has gone from a few dollars to over $60,000 and then back down to around $30,000 within a few months.

- Security risks: Even though blockchain technology is very secure, people can still lose money in other ways. For instance, if someone hacks into your digital wallet where you store your cryptocurrency, you might lose all your funds, and there is usually no way to recover them.

- Regulation: Cryptocurrencies exist in a gray area of regulation. Different countries have different laws, and some governments have banned or heavily restricted the use of cryptocurrencies. This can create uncertainty for users, as regulations can change quickly.

- Scams: Because cryptocurrency is a relatively new technology, scammers have found ways to trick people into losing their money. There are fake cryptocurrencies, fraudulent investment schemes, and other scams that target both beginners and experienced users.

Cryptocurrencies in an Investment Portfolio

Cryptocurrency, such as Bitcoin or Ethereum, can be used as part of a well-diversified stock and bond portfolio. It's very different from bonds and stocks because it can be highly volatile and carries additional significant risks, as explained above.

There are several strategies to consider when adding cryptocurrency to a portfolio:

- Small Allocation for Higher Returns: Investors could allocate a small portion of their portfolio (e.g., 1-5%) to cryptocurrencies. This would allow them to benefit from the potential upside without exposing too much of their money to risk. For example:

- Growth-Oriented Strategy: For investors willing to take on more risk, a higher allocation (5-10%) to cryptocurrency could be part of a growth-oriented strategy. In this case, the goal would be to achieve higher returns, accepting the possibility of more dramatic ups and downs in the portfolio’s value.

- Stablecoins for Stability: Stablecoins, such as Tether (USDT) are designed to maintain a fixed value, usually pegged to a traditional currency like the US dollar. For more conservative investors, stablecoins can provide exposure to crypto without the extreme price swings. These could serve as an alternative to cash or short-term bonds in a portfolio.

Conclusion

Cryptocurrencies are reshaping how we think about money, ownership, and finance. From Bitcoin's role as digital gold to Ethereum’s smart contracts and decentralized applications, each cryptocurrency serves different purposes. However, it's crucial to understand the risks, such as volatility, security concerns, and regulatory issues before proceeding with any investments. Before investing in cryptocurrencies (or any asset), it’s essential to consult a qualified financial professional. They can conduct a suitability assessment to ensure these products align with your financial goals, risk tolerance, and ability to manage potential investment risks.

CFA Society Cyprus Financial Literacy Committee Member

Director, Moody's Credit Risk Solutions & Services

RiskMatrix Ltd

[1] Sources: Investing.com for BTC and XAU/USD prices, https://www.usinflationcalculator.com/inflation/consumer-price-index-and-annual-percent-changes-from-1913-to-2008/ for US CPI data.

3287.99

3287.99 1275.09

1275.09