03/09/2015 06:46

The still challenging economic environment in which businesses have to operate in, is evident in the public companies' results of the first half of 2015.

This picture prevails throughout the spectrum of the economic sectors as companies of all types found it difficult to produce meaningful profits.

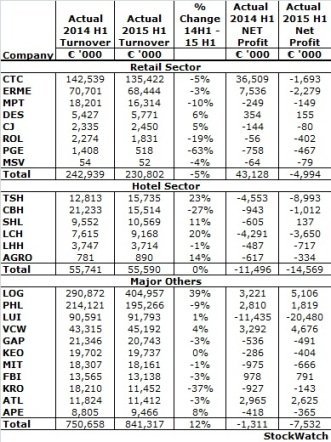

Retail sector

Almost all of the companies of the retail sector witnessed a decline of their operations as evidenced by the fall in their turnovers.

CTC which due to its size and diversity of activities is the most representative such company listed in the CSE, saw its turnover decline by 5% while ERME which is a CTC's subsidiary, had a 3% fall in sales.

The overall change in the turnover of the eight companies of the sector is -5%.

In terms of profitability, data suggest that companies have still a long way to go before they are in a position to produce positive results for their stockholders as all but one of the sector's companies were in the red.

In terms of profitability, data suggest that companies have still a long way to go before they are in a position to produce positive results for their stockholders as all but one of the sector's companies were in the red.

Only DES managed to turn a profit and that is much lower than last year's corresponding figure.

The picture for the first half of last year would be very similar if not for CTC's and ERME's extraordinary profit of €40mn and €10,2 mn respectively in 2014, from the sale of their positions in CTC-ARI (Holdings) Ltd and Cyprus Airports (F&B) Ltd.

Hotels

The hotel industry traditionally shows a loss during the first half of the year due to seasonality factors.

Hotel-related turnover was increased due to improved hotel occupancy ratios and in the case of TSH the operation for the entire period of the new hotel King Evelthon Beach Hotel & Resort in Paphos.

But, much lower property sales by CBH resulted in the overall turnover remaining constant.

Net losses were exacerbated due to foreign exchange losses especially by TSH.

Others

The majority of the rest of the companies either remained in the red or achieved lower profits from last year (PHL, FBI, ATL).

The exception is LOG and VCW which having a strong presence in foreign markets managed to increase both their turnover and net profit.

Excluding LOG's sales, the total turnover of the rest of the major companies declined by 5%.

Banks and investment companies are not examined in this analysis.

This picture prevails throughout the spectrum of the economic sectors as companies of all types found it difficult to produce meaningful profits.

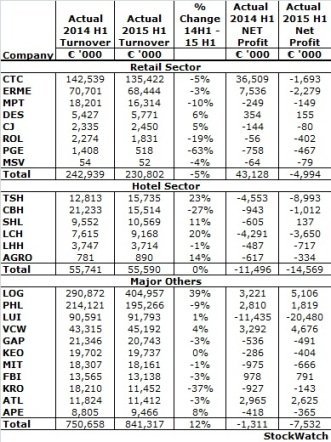

Retail sector

Almost all of the companies of the retail sector witnessed a decline of their operations as evidenced by the fall in their turnovers.

CTC which due to its size and diversity of activities is the most representative such company listed in the CSE, saw its turnover decline by 5% while ERME which is a CTC's subsidiary, had a 3% fall in sales.

The overall change in the turnover of the eight companies of the sector is -5%.

In terms of profitability, data suggest that companies have still a long way to go before they are in a position to produce positive results for their stockholders as all but one of the sector's companies were in the red.

In terms of profitability, data suggest that companies have still a long way to go before they are in a position to produce positive results for their stockholders as all but one of the sector's companies were in the red.Only DES managed to turn a profit and that is much lower than last year's corresponding figure.

The picture for the first half of last year would be very similar if not for CTC's and ERME's extraordinary profit of €40mn and €10,2 mn respectively in 2014, from the sale of their positions in CTC-ARI (Holdings) Ltd and Cyprus Airports (F&B) Ltd.

Hotels

The hotel industry traditionally shows a loss during the first half of the year due to seasonality factors.

Hotel-related turnover was increased due to improved hotel occupancy ratios and in the case of TSH the operation for the entire period of the new hotel King Evelthon Beach Hotel & Resort in Paphos.

But, much lower property sales by CBH resulted in the overall turnover remaining constant.

Net losses were exacerbated due to foreign exchange losses especially by TSH.

Others

The majority of the rest of the companies either remained in the red or achieved lower profits from last year (PHL, FBI, ATL).

The exception is LOG and VCW which having a strong presence in foreign markets managed to increase both their turnover and net profit.

Excluding LOG's sales, the total turnover of the rest of the major companies declined by 5%.

Banks and investment companies are not examined in this analysis.